Chase Check Deposit

- Morgan’s website and/or mobile terms, privacy and security policies don’t apply to the site or app you're about to visit. Please review its terms, privacy and security policies to see how they apply to you. Morgan isn’t responsible for (and doesn’t provide) any products, services or content at this third-party site or app, except for products and services that explicitly.

- Call Chase at 800-935-9935 and verify Login to your Chase online account, they should show your account number on your statements The spot for your account number on a Chase Deposit Slip.

- Monthly fee: $12, avoided by having monthly direct deposits of $500 or more, a minimum daily balance of $1,500, or keeping a daily average balance of $5,000 in your Chase Total Checking®.

Please turn on JavaScript in your browser

It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

Set up direct deposit

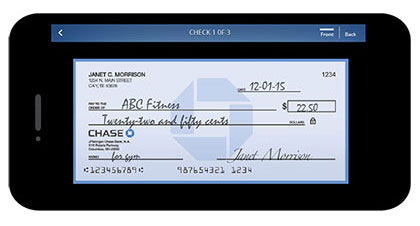

Subscribe to Chase here: how to deposit a check using the Chase Mobile® App by taking a picture with your mobile phone.

- Add money

- Checkbook orders

- Routing and account number

- Direct deposit

- View checks

- Overdraft Services

The fastest, safest way to deposit your paycheck

You can get a pre-filled direct deposit form or complete one yourself

Get your personalized pre-filled direct deposit form

Chase Check Deposit Hold

- Sign in to chase.com or the Chase Mobile® app

- Choose the checking account you want to receive your direct deposit

- Navigate to Account Services by scrolling up in the mobile app or in the drop down menu on chase.com

- Click or tap on Setup direct deposit form

- We've pre-filled your direct deposit form to save you time

- Download, print or email the form

Complete a direct deposit form yourself:

- Download the form (PDF)

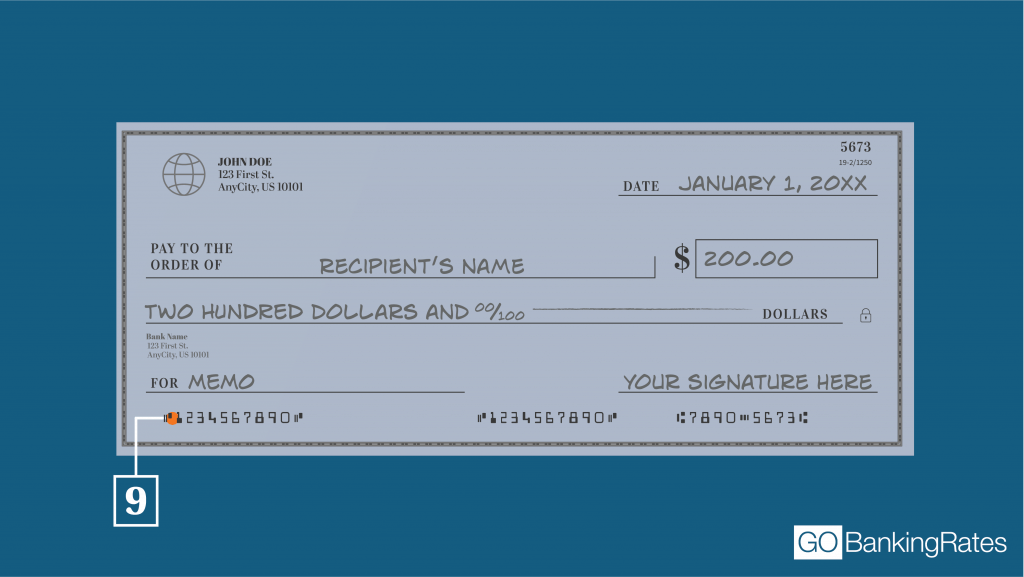

- Locate your 9-digit routing and account numbers - here's how to find them

- Fill in your other personal information

- Give the completed form to your employer

Common questions answered

What if I have U.S. government benefit income such as Social Security or military pay?

expand

Go to fiscal.treasury.gov/GoDirect to enroll.

Chase Quick Deposit Online

How do I set up direct deposit?

expand- Complete the direct deposit form.

- Deliver the form and a voided check to your company’s payroll department.

- If you’re eligible, your employer will deposit your paycheck directly into your account.

- Confirm the deposit each pay cycle by signing in to Chase OnlineSM or checking your account statement.

What information do I need to provide in order to set up direct deposit?

expand- Your employer or depositor’s name and address

- Your Employee ID or account number with depositor

- Your account number

- Your routing/ABA number

How quickly does direct deposit take effect?

expandDirect deposit usually takes up to two pay cycles to kick in. However, it’s different for each employer. Please check directly with your employer for specific timing.

Have more questions?

Chase Check Deposit Hold

return to footnote reference1Savings-account interest is compounded and credited monthly, based on the daily collected balance. Interest rates are variable and determined daily at Chase's discretion and are subject to change without notice. Balance tiers are applicable as of the effective date of these rates and may change at Chase's discretion. Account fees could reduce earnings. CD interest is fixed for the duration of the term and is compounded daily.

Chase Check Deposit

return to footnote reference2For Chase Premier SavingsSM: Earn Premier relationship rates when you link the account to a Chase Premier Plus CheckingSM or Chase SapphireSM Checking account, and make at least five customer-initiated transactions in a monthly statement period using your linked checking account. See interest rates.

Savings Text Message Program: Message and data rates may apply. For Help call 1-800-935-9935. Reply STOP to 33172 to no longer receive Chase Savings text messages until you provide your consent again. Mobile carriers not liable for delayed or undelivered messages.

IMPORTANT INFORMATION

The content of this page is informational only. Accounts are subject to approval. The terms of the accounts, including any fees or features, may change. See the Deposit Account Agreement and Additional Banking Services and Fees for the terms and conditions associated with these products.