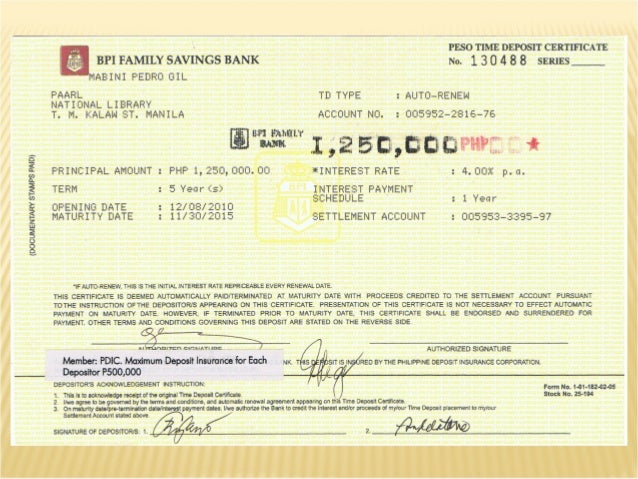

Bpi Time Deposit

What is BPI Express Start?

BPI Express Start is the fastest way to get a BPI Express Credit or BPI Family Bank Credit Card. No need to submit any income documents!

BPI 1 Month Time Deposit. Type Fixed: Rate 0.875%: Currency: PHP: Rate is for a 'Regular Time Deposit (Peso)' deposit of 5 MM and up and for 35 days. The rate of 0.875% is 0.21% lower than the average 1.08%. Also it is 2.125% lower than the highest rate 3.00 Updated Jun, 2018. Type of Deposit Account. Required Initial Deposit. Required Minimum Monthly ADB(1) Required Daily Balance(2) to Earn Interest. Interest Rate(3) (Per Annum) Peso Savings Account. BPInoy Savings: N.A. (For as long as there is a remittance transaction at least once every three months) Php 500. BPI Direct Express Teller Savings: Php.

- With BPI Time Deposit, you enjoy higher returns with no risk on your principal. What type of time deposits do you need?

- The Cash Accept Machine is a deposit facility that allows BPI and BPI Family Savings Bank cardholders to make actual cash deposits via a machine that accepts cash in PHP 100, PHP 500 and PHP 1000 denominations. Deposit cash at your most convenient time.

How to apply?

What are the acceptable types of deposits for Hold-Out*?

Bpi Time Deposit Sample Computation

- ATM-based Savings

- Passbook Savings

- Time Deposit

*Hold-out amount should be at least P10,000 for ATM-based and Passbook Savings;

P50,000 for Time Deposit

How much is the credit limit?

Applicant may get a credit limit of up to 90% of his/her hold-out deposit amount.

To Illustrate: P10, 000 ATM Savings Account x 90% = P9, 000 credit card limit

What are the requirements to apply for a credit card via BPI Express Start?

¨ Must be at least 18 years old

¨ Must have a business or residence contact number

¨ Completely filled out and signed Express Start Application Form*

¨ Completely filled out and signed Deed of Assignment*

*Available at any BPI/BPI Family Savings Bank branch nationwide.

NOTE:

A Non-Filipino Resident must submit his Alien Certificate of Registration (ACR), work permit or Embassy Accreditation Papers.

The Terms and Conditions governing the issuance and use of the BPI Express Credit and/or BPI Family Bank Credit Card, whichever is applicable, applies to all credit cards issued

For inquiries and comments, please send us a message through www.bpi.com.ph/contactus or call our 24-hour BPI Contact Center at (+632) 889-10000.Regulated by the Banko Sentral ng Pilipinas with email address at consumeraffairs@bsp.gov.ph.